- Services

Technology Capabilities

Technology Capabilities- Product Strategy & Experience DesignDefine software-driven value chains, create purposeful interactions, and develop new segments and offerings.

- Digital Business TransformationAdvance your digital transformation journey.

- Intelligence EngineeringLeverage data and AI to transform products, operations, and outcomes.

- Software Product EngineeringCreate high-value products faster with AI-powered and human-driven engineering.

- Technology ModernizationTackle technology modernization with approaches that reduce risk and maximize impact.

- Embedded Engineering & IT/OT TransformationDevelop embedded software and hardware. Build IoT and IT/OT solutions.

- Industries

- GlobalLogic VelocityAI

- Insights

BlogsDecember 16, 2024Gene LeybzonAccelerating Digital Transformation with Structured AI Outputs

This code produces the following output that can be imported into the candidate trackin...

BlogsOctober 30, 2024Yuriy Yuzifovich

BlogsOctober 30, 2024Yuriy YuzifovichAccelerating Enterprise Value with AI

Discover how financial services integrations are transforming from standalone offerings...

- About Us

Press ReleaseGlobalLogicMarch 11, 2025GlobalLogic Launches VelocityAI to Harness the Power of AI, ...

VelocityAI combines advanced AI technologies with human expertise, helping businesses r...

Press ReleaseGlobalLogicJanuary 10, 2025

Press ReleaseGlobalLogicJanuary 10, 2025GlobalLogic Announces Leadership Change: Srini Shankar Appointed ...

SANTA CLARA, Calif.–January 10, 2025– GlobalLogic Inc., a Hitachi Group Com...

- Careers

Case StudiesDigital Banking Payment Hub

Share

Overview

Payments hubs are centralized systems that actively supports payment transactions across multiple channels and businesses to create a fully unified banking platform. Under this umbrella sits payment gateways and payment networks – both of which are essentially to the seamless running of this unified platform.

Payment gateways need to deliver 100 percent uptime to their customers, while protecting all aspects of the network from security breaches and fraud. Payment networks on the other hand, have to maintain a complex set of network communications with banks and deal with the multitude of international differences between systems and processes.

Banks that receive and process payments also have to cope with a multitude of systems and varying levels of performance. This results in a need to aggregate the payments received across all of the supported networks so that they can obtain a single view of customers, merchants and networks; it helps them make things secure and identify suspicious behavior faster.

But it doesn’t stop there. Payments generate large and complex messages that include information on the payment, merchant and recipient and the routing data that allows the payment to reach its destination. All of these factors, combined with very high volumes and inconsistent traffic, require all participants to deliver high levels of technical performance.

Banks are looking to differentiate their services and win market share by offering customers a superior online and app-based banking experience. This includes being able to protect customer data and deliver secure experiences online. But being able to secure complex online payment applications that depend on numerous technologies presents many operational challenges.

So, how can you overcome these operational challenges?

The Challenge

This challenge resonates with a leading UK retail bank that was looking to data and monitoring tools to gain a 360 view of the customer experience across all devices (Mobile, Mobile Browser & Desktop included). In order to do this, the bank needed to gain operational and business insights from the payments hub behind all components and digital platforms.

The need for real-time events & transactions monitoring was even more important considering the bank had 14 million+ active customers and payment journeys were calling for a new Strong Customer Authentication (SCA) stack. This included monitoring of the payments stack and backend database (including Faster Payments, International Payments, future Dated Payments & Standing order).

Whilst responsibility was placed on both operational support teams & product owners, as far as regulations were concerned, it was up to the bank to rollout a new service that could start calling SCA stack for authentication. And they had a tight timeframe to get everything in place.The Solution

Whilst the bank had multiple tools for monitoring payments service and different siloed environments, none of these were suitable for operational perspective or an increased mean time to repair (MTTR) during investigation.

GlobalLogic invited to help the bank implement an AIOps solution that dealt with automated instances and delivered a holistic view of end-to-end services around their payment monitoring efforts. After evaluating the current infrastructure, we looked to Splunk software to help the bank monitor, search, analyze, visualize, and act on massive streams of real-time and historical machine data from any source, format, and location.

Successful integration of multiple tools enabled the bank to thoroughly understand the payments journey flow and architecture. GlobalLogic were then able to create personalised dashboards with Operational View and Product Owner view for specific business insights, giving the bank access to never before seen business analytics and customer insights. Part of the solution also involved indexing web and mobile applications which has delivered real-time data on events and transactions.

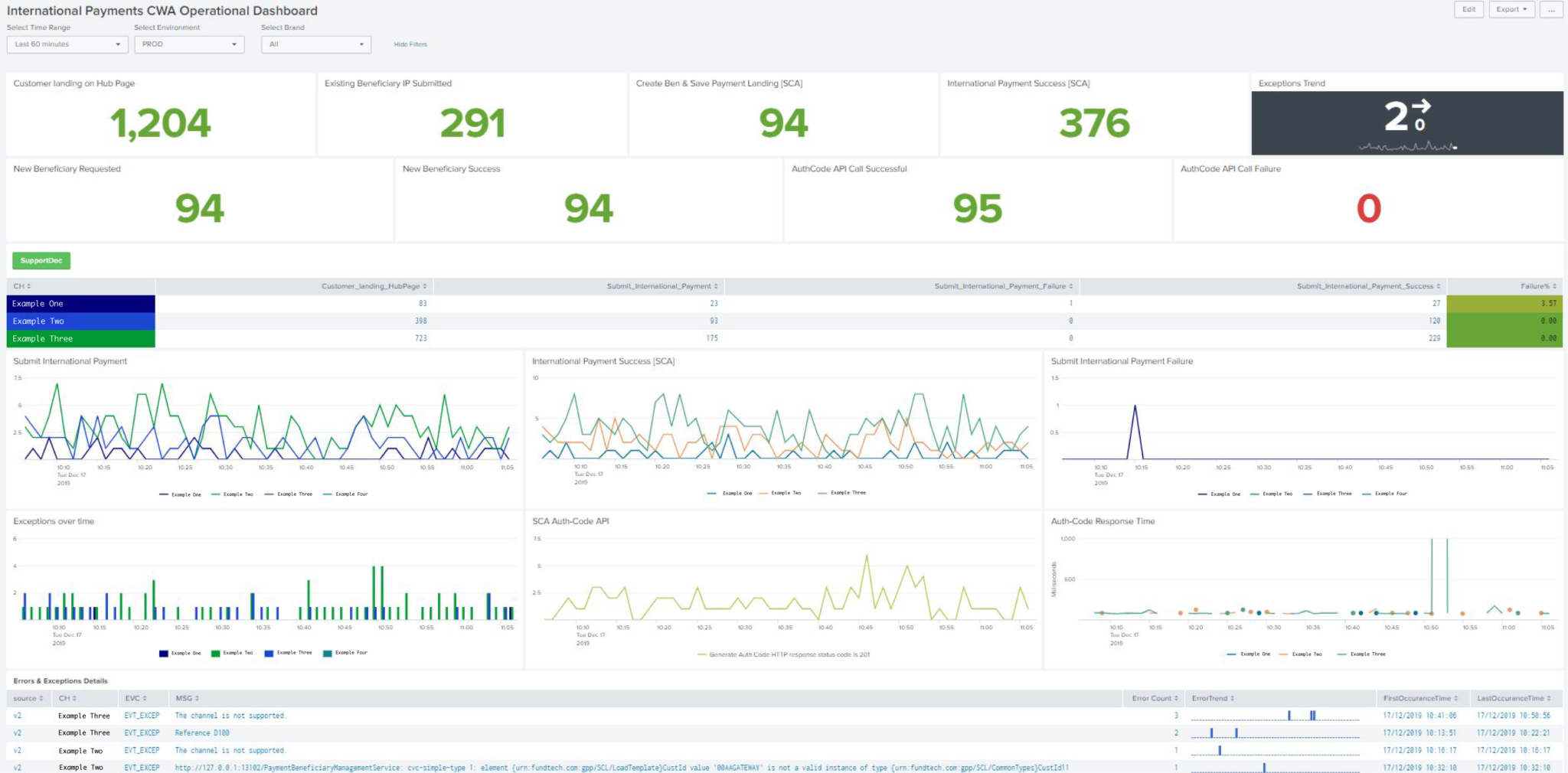

You can see sample dashboards below. Both variations monitor payments stack & backend database (including FutureDatedPayments & Standing order). This helps support both Operational support teams & Product Owner as it provides required BI for decision making. From here, we created a holistic view of end-to-end services, monitoring success and failure metrics by brand and device (Mobile & desktop). Collectively, these new AI and ML-enabled tools and data-driven analysis have enabled the smooth rollout of new features, including monitoring of calls to the new SCA stack and live monitoring of service. New routes to live process were also established, enabling live monitoring of online services in lower environments before deployment.

Faster Payments Dashboard

International Payments Dashboard

The Benefits

- Identified gaps in monitoring, saving our client a projected £1-3 million annually.

- Introduction of SCA reduced the risk of going live.

- 360-degree view for Product Owners providing end-to-end view of the service.

- Business impacts included a reduced issue resolution time and enhanced user experience, yielding cost savings and greater productivity.

- Increased visibility – more reliable service through increased service availability.

- Payments service reported higher availability in regulatory reports compared to previous reports.

- Moved from reactive to proactive stage and preventing outages.

- Faster mean time to resolution (MTTR), reducing time by 50%.

- Faster response time in case of incidents and ability to more accurately pinpoint source of failure.

- Splunk dashboards make it easy to track common security issues or KPIs important to the business, enabling them to make informed decisions and take action to protect and grow the bank.

- The bank is PCI DSS compliant and achieves a data platform upon which other regulations and reports can be managed.

The need for real-time events & transactions monitoring is one shared across the financial industry. Fortunately, modern tools such as Splunk software enables organizations to gain a holistic view of their payments journey flow and architecture, highlighting gaps in the armor. These insights empower organizations to adopt a data-driven approach to their digital strategy, creating solutions that can seamlessly roll out new features and directly target failure points to reduce risk and deliver an enhanced user experience.

Related Content

Blogs4 March 2025The Future of Agentic AI: Designing Reliable Systems for Enterprise Success

AI GovernanceAI-Powered SDLCMLOpsCross-Industry Case StudiesGlobalLogic

Case StudiesGlobalLogicTransforming CX for a Leading Telecom Provider with AI/ML-Driven Intelligence

Discover how GlobalLogic’s AI/ML-driven analytics platform helped a top U.S....

AnalyticsData EngineeringMLOpsCommunications and Network Providers Case StudiesGlobalLogic

Case StudiesGlobalLogicCatalina evolves from coupons to AI-driven connections

Digital media solution partner seeks GlobalLogic support on Big Data...

AnalyticsData EngineeringRetail and Consumer Get in touch

Get in touchLet’s start engineering impact together.

GlobalLogic provides unique experience and expertise at the intersection of data, design, and engineering.