- Services

Technology Capabilities

Technology Capabilities- Product Strategy & Experience DesignDefine software-driven value chains, create purposeful interactions, and develop new segments and offerings

- Digital Business TransformationAdvance your digital transformation journey.

- Intelligence EngineeringLeverage data and AI to transform products, operations, and outcomes.

- Software Product EngineeringCreate high-value products faster with AI-powered and human-driven engineering.

- Technology ModernizationTackle technology modernization with approaches that reduce risk and maximize impact.

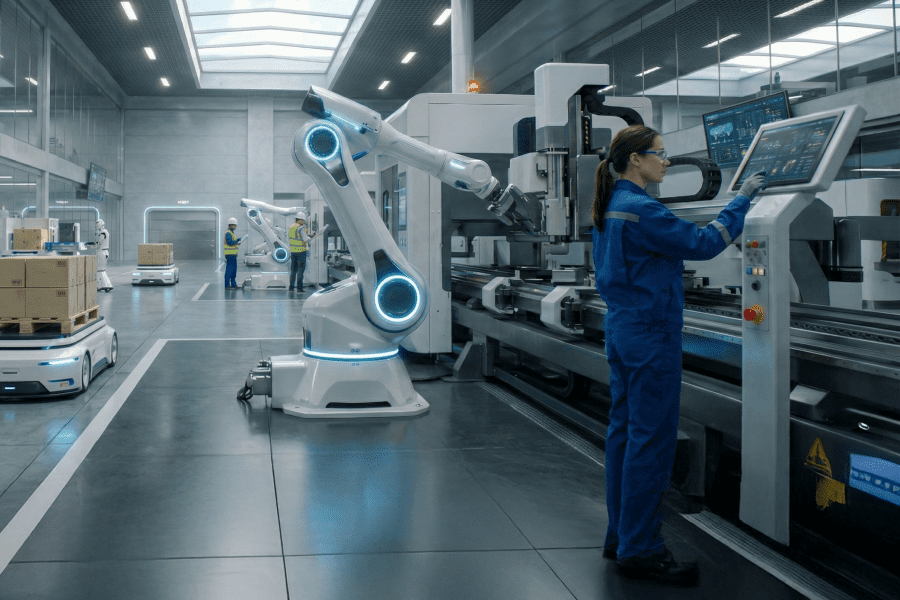

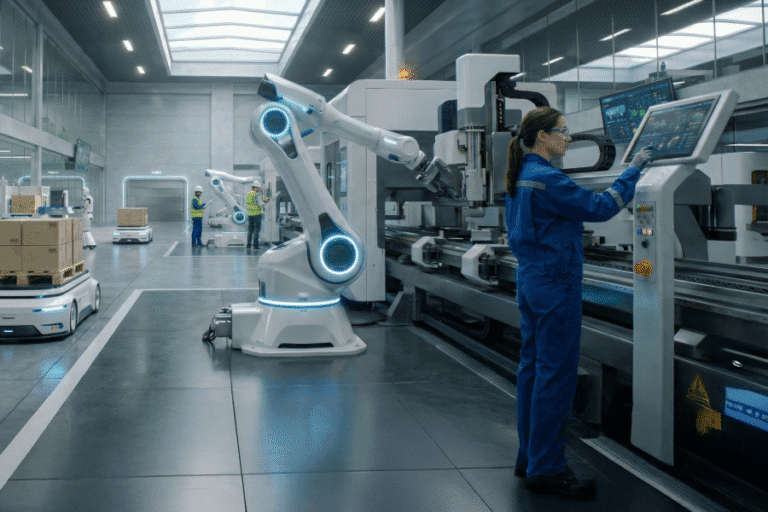

- Embedded Engineering & IT/OT TransformationDevelop embedded software and hardware. Build IoT and IT/OT solutions.

- Industries

- GlobalLogic VelocityAI

- Insights

BlogsGlobalLogicJuly 27, 2023Exploring Snowpark and Streamlit for Data Science

I’m Janki Makwana, a Data Scientist at GlobalLogic. I have been working with a major re...

BlogsJuly 18, 2023Manik Jandial

BlogsJuly 18, 2023Manik JandialView on payment industry modernisation: Enablers of change

Welcome to the second part of our two-part series on the evolving payment industry! In ...

- About

BlogsBlogsGlobalLogic18 December 2025Physical AI: Bringing Intelligence to the Edge of Action

At GlobalLogic, we’re building systems that don’t just ...

BlogsBlogsBlogsBlogsBlogsBlogsBlogsBlogsLoading...

How can I help you?

How can I help you?

Hi there — how can I assist you today?

Explore our services, industries, career opportunities, and more.

Powered by Gemini. GenAI responses may be inaccurate—please verify. By using this chat, you agree to GlobalLogic's Terms of Service and Privacy Policy.