- Služby

Technologické riešenia

Technologické riešenia- Produktová stratégia a UX dizajnDefinujte softvérové hodnotové reťazce, vytvárajte účelné interakcie a vyvíjajte nové segmenty a ponuky.

- Transformácia digitálnych podnikovNapredujte na ceste digitálnej transformácie.

- Technologická modernizáciaModernizujte technológie pomocou prístupov znižujúcich riziko a maximalizujúcich efekt.

- Riešenia pre informovanosťVyužite umelú inteligenciu na monetizáciu údajov v rámci svojich produktov, služieb

- Vývoj softvérových produktovInovujte, adaptujte a zrýchľujte toky svojich príjmov pomocou softvérových riešení na báze AI.

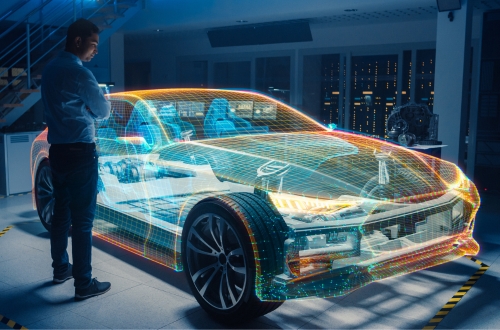

- Vývoj embedded riešení a transformácia IT/OTVyvíjajte a udržiavajte chip-to-cloud softvér pre prepojené produkty.

- Odvetvia

- GlobalLogic VelocityAI

- Náš pohľad

BlogsSeptember 25, 2024Zuzana KravecováPrvé kroky k úspešnej IT kariére – stáž v GlobalLogic ...

Študentom ponúkame príležitosť získať praktické skúsenosti prostredníctvom nášho Intern...

BlogsMay 21, 2024Abhishek Gedam

BlogsMay 21, 2024Abhishek GedamNFR: 12 kľúčových aspektov pre vývoj mobilných aplikácií

Keď koncipujeme nový softvér, zvyčajne sa sústredíme na jeho funkcie a vplyv na spoločn...

- O nás

Press ReleaseGlobalLogicJanuary 14, 2025Spoločnosť GlobalLogic oznámila zmenu vo vedení: novým ...

SANTA CLARA, Kalifornia – 10. januára 2025 – Spoločnosť GlobalLogic Inc., člen skupiny ...

Press ReleaseGlobalLogicDecember 18, 2024

Press ReleaseGlobalLogicDecember 18, 2024Spoločnosti GlobalLogic a Nokia spájajú sily, aby ...

Tretí ročník Akadémie SOVY otvára nové príležitosti pre mladé talenty v informačných te...

- Kariéra

Nechajte sa inšpirovať inovatívnymi myšlienkami od lídrov a inžinierov z GlobalLogic

BlogsBlogsBlogsBlogs23 April 2024GlobalLogicŽeny prinášajú do IT iný pohľad

Ženy do väčšinou mužských kolektívov v IT prinášaju iné pohľady...

BlogsBlogsBlogs8 February 2024GlobalLogicDiplomová práca ju dostala na víťazné pódium

Odborná porota ju vybrala medzi 10 najlepších diplomových prác v...

BlogsBlogsBlogs