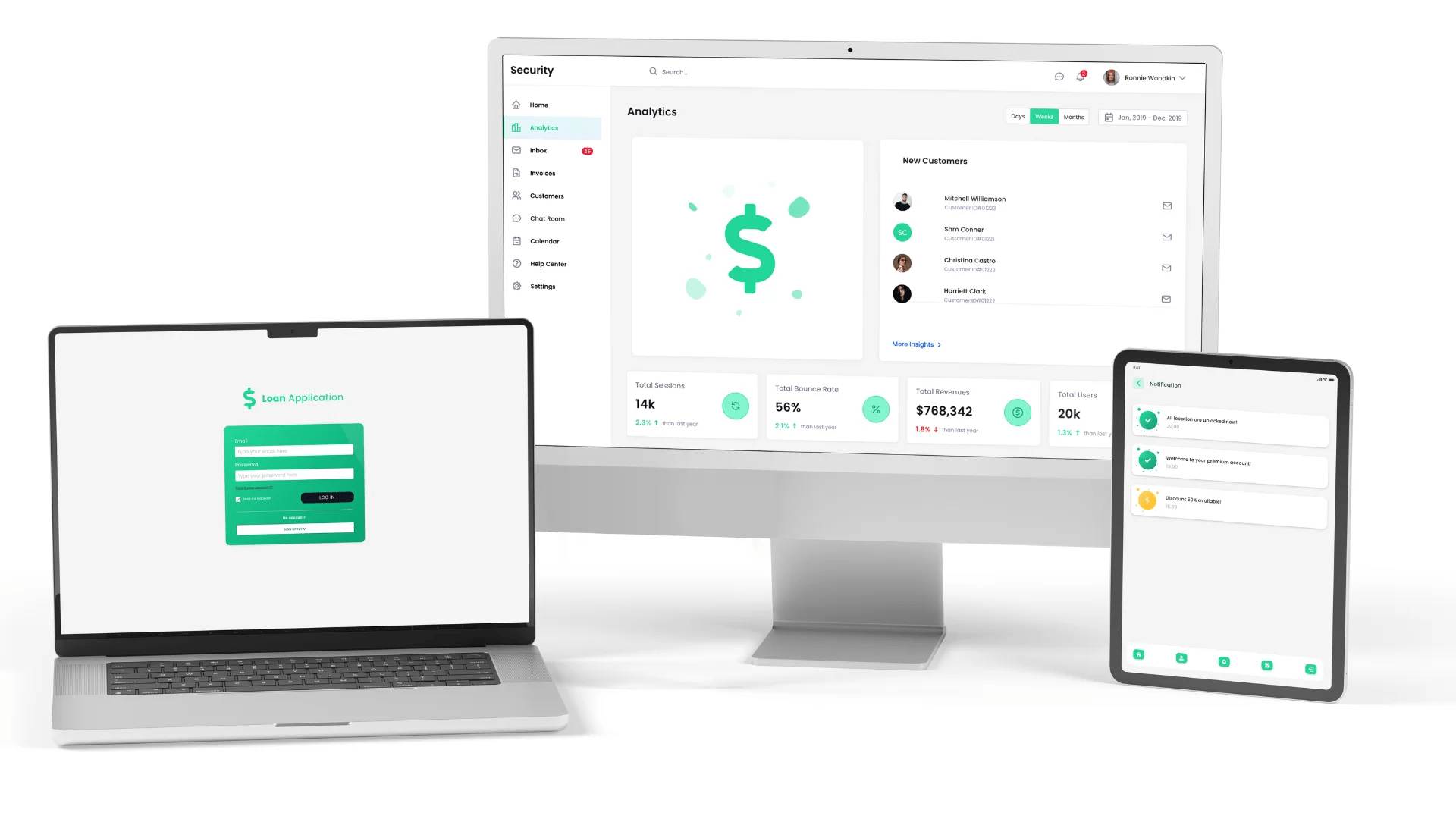

Solution

A banking application designed to digitize and facilitate the lending process and reduce the physical time spent by customers at their local branches. The financial solution is designed to automate the end-to-end personal loan application process through a cross-platform software application.

The app evaluates customers based on risk criteria, cuts the time spent applying for a loan to a matter of minutes, and wastes no paper in the process. APIs from multiple regulatory agencies and from the internal bank of the client are integrated into the solution to ensure the lending process is compliant with all EU regulations and its workflow is automated across the banking systems.

The solution relies on a microservices architecture, with Java and Spring Boot as the main technologies for the back-end. The microservices communicate internally through queues using RabbitMQ with data structures of JSON type. JavaScript with Angular and CSS are being used for the front-end.

Collaboration

The client is part of one of the largest financial service providers in the CEE region and a leading retail banking provider in the local market.

When we started the collaboration, the client was looking for a software services company that could integrate into their ecosystem and augment their existing teams to accelerate time-to-market for their solutions. Our Agile competencies combined with financial software development know-how and the capacity to attract and retain talent played an important role in setting the base for a successful partnership with the client.