- Services

Technology Capabilities

Technology Capabilities- Product Strategy & Experience DesignDefine software-driven value chains, create purposeful interactions, and develop new segments and offerings

- Digital Business TransformationAdvance your digital transformation journey.

- Intelligence EngineeringLeverage data and AI to transform products, operations, and outcomes.

- Software Product EngineeringCreate high-value products faster with AI-powered and human-driven engineering.

- Technology ModernizationTackle technology modernization with approaches that reduce risk and maximize impact.

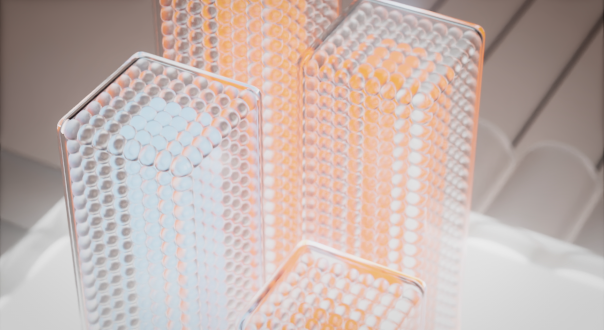

- Embedded Engineering & IT/OT TransformationDevelop embedded software and hardware. Build IoT and IT/OT solutions.

- Industries

- GlobalLogic VelocityAI

- Insights

BlogsNovember 6, 2023GlobalLogicOntology – key Enabler of Next-Gen Technologies

Every big or mid-sized company has a proliferation of sites, edge devices, apps, and di...

BlogsNovember 30, 2023GlobalLogic

BlogsNovember 30, 2023GlobalLogicSmartphone on Wheels

Over the past decade, cars have undergone a significant transformation to provide a mor...

- About

BlogsBlogs19 February 2025GenAI in Action: Lessons from Industry Leaders on Driving Real ROI

BlogsBlogsBlogsBlogsBlogsBlogsBlogsBlogs